The Long View

How To Achieve 5, 10, or Even 100 Baggers Without Taking on Crazy Risk

The information contained in this free investing series is core to constructing asymmetric portfolios. Master this skill, and you'll be rewarded.

How To Achieve 5, 10, or Even 100 Baggers Without Taking on Crazy Risk

We specialize in making businesses like yours more money. Let's start with an audit of your current marketing.

What Is Asymmetric Investing?

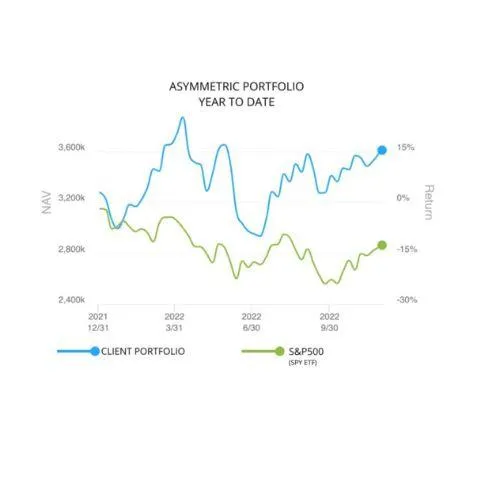

Asymmetric Investing is a Low-Risk, High-Return Strategy for Long-Term Financial Growth in The Stock Market!

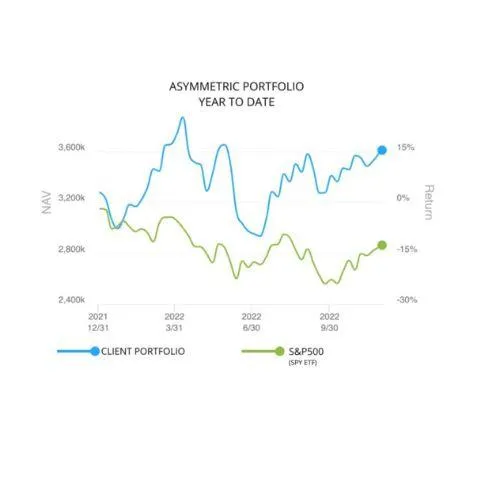

What sets this strategy apart is the balance between enormous upside potential and manageable downside risks.

While most market players focus on potential gains, the asymmetric strategy excels in keeping the risks low. This dual focus is the cornerstone of a good asymmetric portfolio.

Asymmetric Investing is a Low-Risk, High-Return Strategy for Long-Term Financial Growth in The Stock Market!

What sets this strategy apart is the balance between enormous upside potential and manageable downside risks.

While most market players focus on potential gains, the asymmetric strategy excels in keeping the risks low. This dual focus is the cornerstone of a good asymmetric portfolio.

Get Access to Asymmetric Investing Fundamentals

In this free email series I will walk you through the basics of Asymmetric Investing. I'll start with the philosophy, why it works, and why the best portfolio managers use this strategy for themselves and their clients. I'll teach you to think about portfolio construction from a big picture perspective instead of an individual stock perspective because a rising tide raises all boats.

Get Access to Asymmetric Investing Fundamentals

In this free video course I will walk you through the basics of Asymmetric Investing.

I'll start with the philosophy, why it works, and why the best portfolio managers use this strategy for themselves and their clients.

I'll teach you to think about portfolio construction from a big picture perspective instead of an individual stock perspective because a rising tide raises all boats.

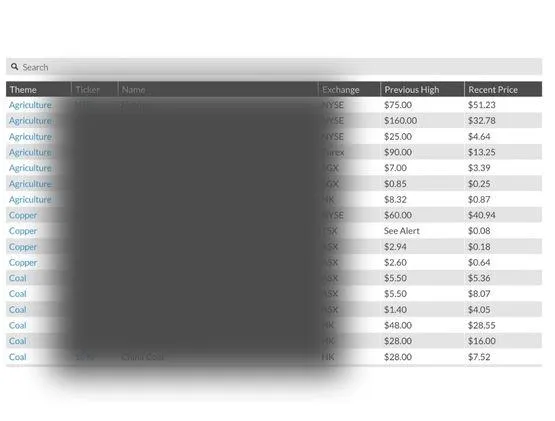

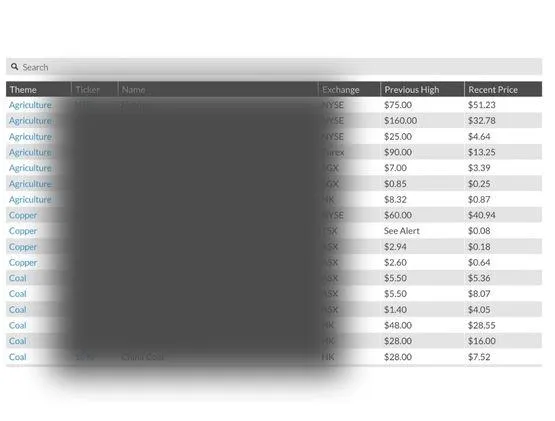

How To Pick Sectors and Investing Themes

The first step to building a healthy stock portfolio has nothing to do with individual companies but rather focuses on the major events and trends that generally dictate the prices of the companies within them.

I'll show you how to determine which sector(s) capital will likely flee and where it will likely fly to.

How To Pick Sectors and Investing Themes

The first step to building a healthy stock portfolio has nothing to do with individual companies but rather focuses on the major events and trends that generally dictate the prices of the companies within them.

I'll show you how to determine which sector(s) capital will likely flee and where it will likely fly to.

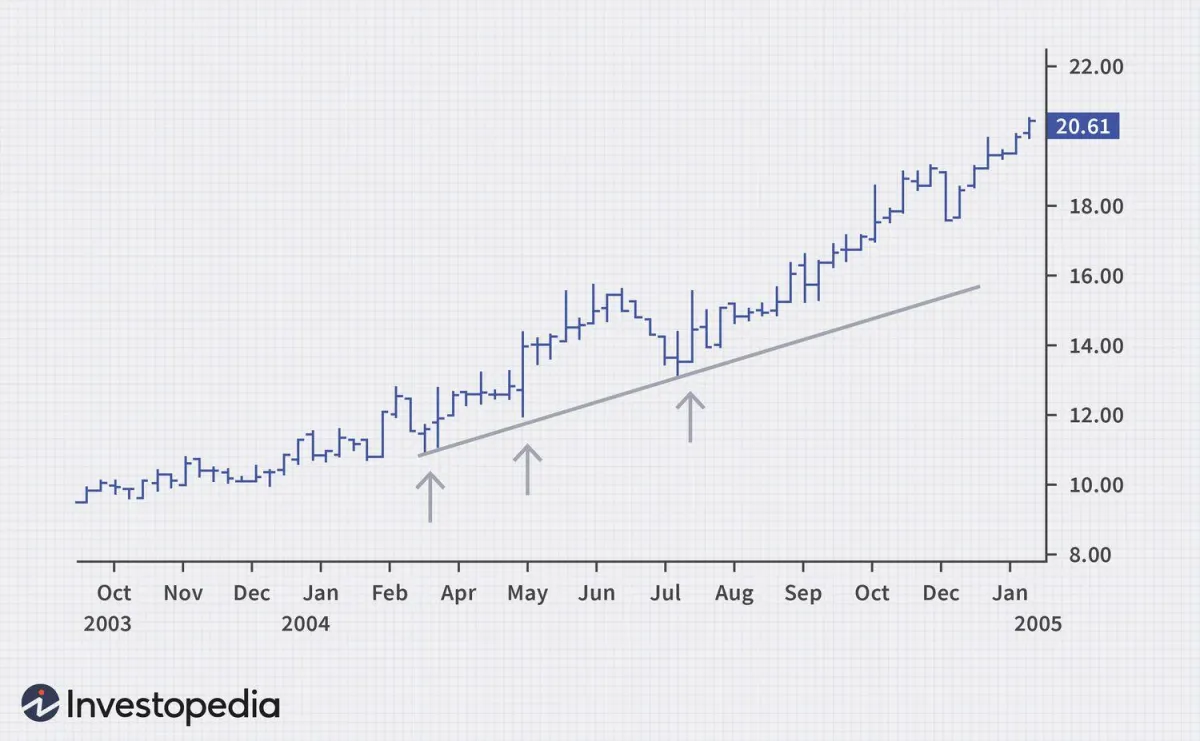

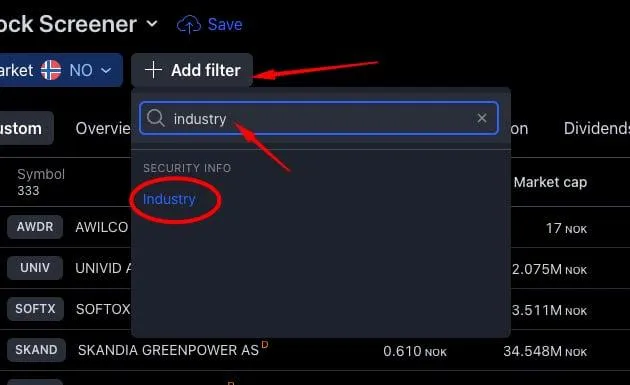

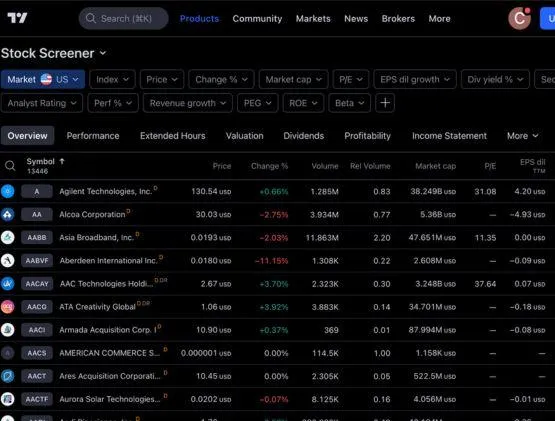

How To Pick Stocks

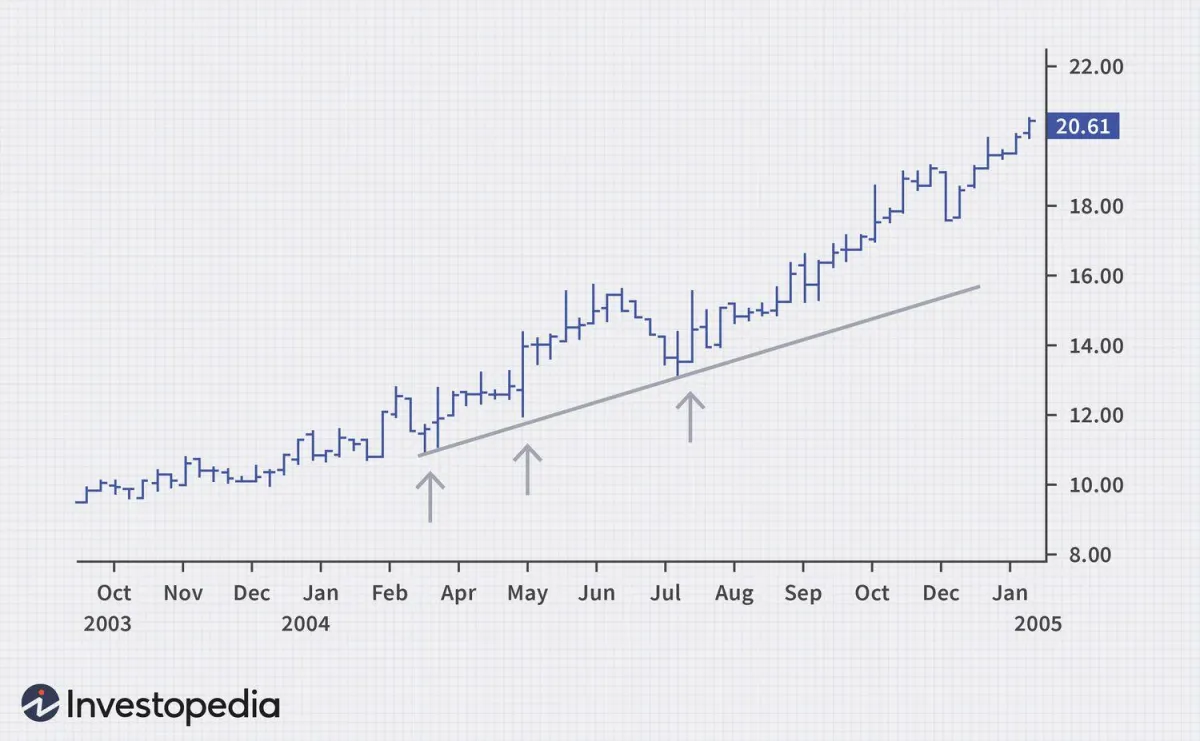

The big idea here is to use current trends and events to work out where capital will flow in the future.

From there, we find sectors or industries that look cheap and then identify companies within those sectors to invest in.

This is how you achieve 5, 10, or even 100 baggers without taking on crazy risks.

How To Pick Stocks

The big idea here is to use current trends and events to work out where capital will flow in the future.

From there, we find sectors or industries that look cheap and then identify companies within those sectors to invest in.

This is how you achieve 5, 10, or even 100 baggers without taking on crazy risks.

How To Manage Your Portfolio

When most people hear "portfolio management," they picture someone at a desk, probably surrounded by screens with flashing green and red numbers all around them, like something you'd see on Wall Street.

However, that's from the world of trading, not investing.

Even if your portfolio has over 100 positions, it shouldn't be difficult to manage

My Favorite Manager That You Should Learn Investing From!

I'll reveal to you my favorite portfolio manager to follow.

I've been speaking to and learning from him for the past 5 years and you should start learning from him as well.

I'll show you how you can access his knowledge and the portfolio he uses with his clients at his hedge fund.

Social Media Management

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

How To Manage Your Own Portfolio

When most people hear "portfolio management," they picture someone at a desk, probably surrounded by screens with flashing green and red numbers all around them, like something you'd see on Wall Street.

However, that's from the world of trading, not investing.

Even if your portfolio has over 100 positions, it shouldn't be difficult to manage

My Favorite Manager That You Should Learn Investing From!

I'll reveal to you my favorite portfolio manager to follow.

I've been speaking to and learning from him for the past 5 years and you should start learning from him as well.

I'll show you how you can access his knowledge and the portfolio he uses with his clients at his hedge fund.

Gene Morris

My name is Gene, and behind the scenes at a top-tier investing community.

We teach asymmetric investing and macroeconomics in our community forum and on live Q&As.

My goal is to give you the investor fundamentals you need to improve your ability to pick sectors, pick stocks, allocate funds, and manage a stock portfolio.

I am most familiar with the asymmetric style of investing since I have the privilege of speaking to portfolio managers who leverage this strategy, multiple times per month inside our forum. I lead the member Q&As.

The information in this series is core to constructing asymmetric portfolios. Master this skill, and you'll be rewarded.

Don't worry. It's not hard. That's the value of good information.

My name is Gene, and behind the scenes at a top-tier investing community called Rebel Capitalist Pro.

We teach asymmetric investing and macroeconomics in our community forum and on live Q&As.

My goal is to give you the investor fundamentals you need to improve your ability to pick sectors, pick stocks, allocate funds, and manage a stock portfolio.

I am most familiar with the asymmetric style of investing since I have the privilege of speaking to portfolio managers who leverage this strategy, multiple times per month inside our forum. I lead the member Q&As.

The information in this series is core to constructing asymmetric portfolios. Master this skill, and you'll be rewarded.

Don't worry. It's not hard. That's the value of good information.

Gene Morris

Long View Lounge

2024 longviewlounge.com. All Rights Reserved. Contact Me. Privacy Policy

Earnings Disclaimer for my free Asymmetric Investing Course: Last Updated: Jan, 2024

1. No Earnings Projections, Promises, Or Representations

You recognize and agree that we have made no implications, warranties, promises, suggestions, projections, representations, or guarantees whatsoever to you about future prospects or earnings, or that you will earn any money, with respect to your purchase of [Your Course Name], and that we have not authorized any such projection, promise, or representation by others.

2. Any Earnings or Income Statements Are Estimates Only

Any earnings or income statements, or any earnings or income examples, are only estimates of what we think you could earn. There is no assurance you will do as well as stated in any examples. If you rely upon any figures provided, you must accept the entire risk of not doing as well as the information provided.

3. There Is No Assurance of Any Income Level

There is no assurance that any prior successes or past results as to earnings or income (whether monetary or advertising credits, whether convertible to cash or not) will apply, nor can any prior successes be used, as an indication of your future success or results from any of the information, content, or strategies.

4. The Economy and Your Risk

The economy, both where you do business, and on a national and even worldwide scale, creates additional uncertainty and economic risk. An economic recession or depression might negatively affect the results produced by [Your Course Name].

5. Your Success or Lack of It

Your success in using the information or strategies provided at [Your Course Name] depends on a variety of factors. We have no way of knowing how well you will do, as we do not know you, your background, your work ethic, or your business skills or practices. Therefore, we do not guarantee or imply that you will get rich, that you will do as well, or that you will have any earnings at all.

6. Internet Businesses and Earnings Derived Therefrom

There are unknown risks in business and on the internet that we cannot foresee which can reduce results. We are not responsible for your actions.

7. Use Caution and Seek the Advice of Qualified Professionals

You should use caution and seek the advice of qualified professionals. Check with your accountant, lawyer, or professional advisor, before acting on this or any information.

8. Users of Our Products, Services, and Website Are Advised to Do Their Own Due Diligence

You agree that our company is not responsible for the success or failure of your business decisions relating to any information presented by our company, or our company products or services.